A Biased View of Home Owners Insurance In Toccoa Ga

Wiki Article

Insurance In Toccoa Ga for Dummies

Table of ContentsGetting The Affordable Care Act Aca In Toccoa Ga To WorkWhat Does Health Insurance In Toccoa Ga Mean?Rumored Buzz on Health Insurance In Toccoa GaThe Single Strategy To Use For Life Insurance In Toccoa Ga

An economic advisor can also aid you decide how best to attain goals like saving for your child's university education and learning or repaying your debt. Monetary advisors are not as well-versed in tax obligation regulation as an accounting professional may be, they can offer some guidance in the tax obligation preparation process.Some financial consultants use estate planning services to their clients. It's crucial for financial consultants to stay up to date with the market, financial conditions and advising best methods.

To sell investment items, experts need to pass the relevant Financial Market Regulatory Authority-administered tests such as the SIE or Series 6 examinations to acquire their qualification. Advisors who want to offer annuities or various other insurance policy products have to have a state insurance license in the state in which they plan to offer them.

Little Known Questions About Medicare Medicaid In Toccoa Ga.

You hire a consultant that charges you 0. Since of the normal fee framework, numerous advisors will certainly not function with clients who have under $1 million in properties to be taken care of.Capitalists with smaller sized portfolios might seek out a financial consultant who charges a hourly charge as opposed to a percentage of AUM. Hourly charges for advisors generally run in between $200 and $400 an hour. The more facility your monetary scenario is, the even more time your expert will certainly need to devote to managing your assets, making it much more pricey.

Advisors are proficient experts that can aid you create a prepare for economic success and apply it. You may additionally think about reaching out to an advisor if your personal economic scenarios have recently become much more challenging. This might indicate getting a residence, marrying, having kids or getting a large inheritance.

Life Insurance In Toccoa Ga Fundamentals Explained

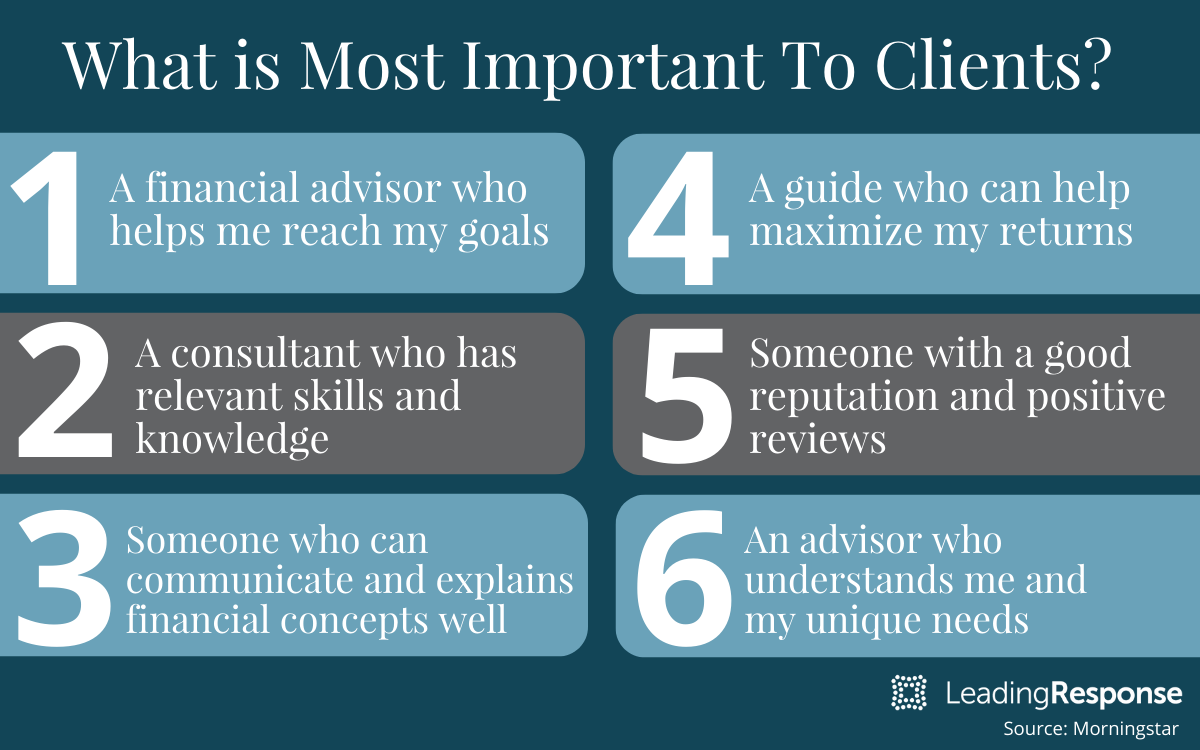

Prior to you fulfill with the consultant for a preliminary consultation, consider what solutions are most crucial to you. You'll want to look for out a consultant who has experience with the solutions you want.The length of time have you been advising? What company were you in before you obtained right into financial suggesting? Who comprises your common client base? Can you give me with names of a few of your customers so I can review your services with them? Will I be dealing with you straight or with an associate consultant? You might additionally intend to look at some example financial strategies from the consultant.

If all the samples you're offered coincide or comparable, it may be an indication that this advisor does not correctly tailor their recommendations for every customer. There are 3 primary kinds of monetary suggesting professionals: Licensed Economic Planner professionals, Chartered Financial Experts and Personal Financial Specialists - https://www.startus.cc/company/thomas-insurance-advisors. The Licensed Financial Coordinator specialist (CFP professional) qualification shows that an advisor has met an expert and moral requirement set by the CFP Board

%20fee%20(1).png)

The Basic Principles Of Insurance In Toccoa Ga

When selecting an economic advisor, take into consideration somebody with a professional credential like a CFP or CFA - https://visual.ly/users/jimthomas30577/portfolio. You could additionally take into consideration an advisor that has experience in the services that are crucial to youThese consultants are generally filled with disputes of interest they're a lot more salesmen than experts. That's why it's vital that you have a consultant who works only in your ideal passion. If you're looking for an expert who can truly provide actual value to you, it is necessary to look into a variety of possible choices, not merely select the very first name that advertises to you.

right here Presently, numerous consultants need to act in your "benefit," yet what that involves can be almost void, other than in the most outright cases. You'll require to find an actual fiduciary. "The very first examination for an excellent monetary expert is if they are benefiting you, as your supporter," says Ed Slott, CPA and founder of "That's what a fiduciary is, however everyone says that, so you'll require other indicators than the advisor's say-so and even their qualifications." Slott suggests that consumers look to see whether experts purchase their recurring education around tax preparation for retired life financial savings such as 401(k) and IRA accounts.

0, which was passed at the end of 2022. "They ought to verify it to you by revealing they have taken severe ongoing training in retirement tax and estate planning," he says. "In my over 40 years of method, I have actually seen pricey irreparable tax errors as a result of lack of knowledge of the tax policies, and it is unfortunately still a big problem." "You need to not attach any kind of expert that doesn't buy their education.

Report this wiki page